CASH has many enemies. Banks have added contactless technology to their credit and debit cards; apps like Uber use pre-stored details for transactions and services such as Venmo allow people to make transfers to one another using only mobile phones. Peter Bofinger of the German Council of Economic Experts says cash should be phased out to save the money spent printing and distributing it, and to eliminate the annoying queues generated by shoppers who insist on using it. Lawmen dislike it, since it is an enticingly anonymous store of value for criminals. Now even central bankers are getting in on the act: the chief economist of the Bank of England has proposed eliminating cash as part of a plan to permit negative interest rates. (Storing bank notes under the mattress is an easy way of thwarting a bank intent on charging negative rates.) Yet for all its detractors, cash is puzzlingly resilient.

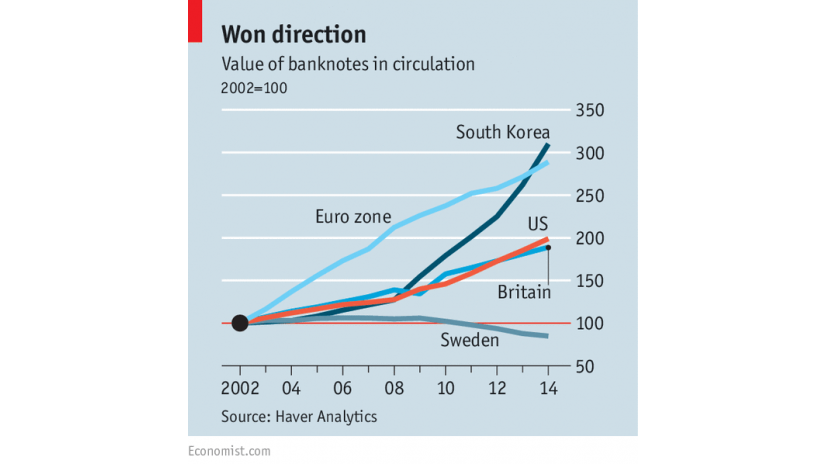

Economists had long assumed that as nations grow richer and their financial infrastructure becomes more elaborate, the amount of cash in circulation would first grow rapidly and then begin to slow, as alternatives gained traction. Eventually, an...Continue reading