Warning light

VOLKSWAGEN doesn’t just make cars. Its enormous lending arm also helps customers to pay for them. With €164 billion ($184 billion) of assets, this is a big business for Germany’s national champion. Others do it too: in all, the finance arms of the world’s top ten carmakers have almost $900 billion of assets on their books. Four firms—VW, BMW, Daimler and Renault—account for half of the $350 billion of debt on the consolidated balance-sheets of carmakers that needs to be refinanced this year. All four of these diesel-focused European carmakers have seen the cost of insuring their debt against default rise sharply since VW’s misdeeds were made public earlier this month.

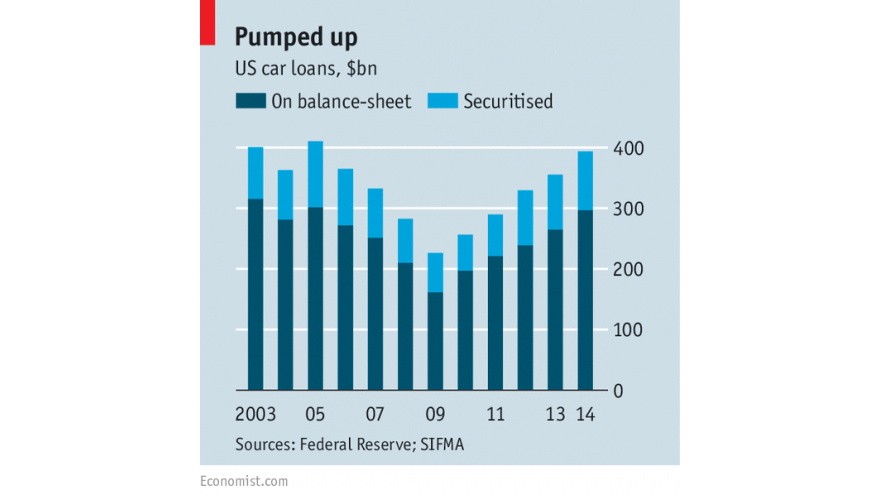

Loans to motorists are fairly short-term, and cars can be repossessed if drivers stop making payments. So this is a relatively low-risk form of lending. But the carmakers are highly dependent on using finance deals to drive sales—VW financed a quarter of the 10m or so vehicles it delivered worldwide last year.

The risk now is that worries about the cost of cleaning up the emissions scandal trigger a cash squeeze. VW is most at risk. It has €67...Continue reading

Comments